Product managers often rely too heavily on very narrow views of market input to decide what features are built into a new product or new release. While the usual stakeholders, including executive and existing customers, deserve to be heard, product managers often over correct their input results in product releases that only satisfy a very small group of potential buyers.

Meanwhile, competitors seem to fluidly introduce new products, releases and ideas that gain acceptance immediately with higher adoption targets. It’s not luck.

The competition isn’t inherently smarter and it’s not because its product teams are smaller (or larger). They simply throw away more ideas than they build.

You can do the same with market discovery, a technique that provides a bigger and better pipeline of market problems, new market opportunities and a method to validate them.

What is Market Discovery?

Market discovery activities are grounded in the market research disciplines you are already familiar with. For a deep dive, take a look at Talking to Humans by Giff Constable About Face 3: The Essentials of Interaction Design by Alan Cooper.

As the on-going, front-end to the lean product management process, market discovery expands some basics beyond users, customers and projects. It incorporates one-on-one interviews to ensure that market data is captured from the entire market.

Consider this—our view of the customer has become too elastic. This is the catch phrase for every outside interaction we have. The term “elastic” is now imprecise and limited usability. What you need to ask is: What customer(s) are you relying on for your market-driven data?

Conducting discovery activities is a concrete way to cast a wide enough net to catch usable market input. We must engage with customers (our own and our competitors), potentials (could be looking but not yet) and non-buyers (haven’t figured out what all the fuss is about).

By soliciting input from all these segments early in the product lifecycle and then disciplinarily deferring and discarding all but a few of the best opportunities, ensure a higher rate of released products that meet the overall success criteria.

Market discovery requires collecting insight and impressions from a relatively small sample size and identifying common themes and trends. (i.e., What issues and opportunities exist for market success by solving urgent and pervasive market problems for one or more of the 3 segments we defined above?)

The result we seek from market discovery is to see big differences or big impacts from the “customers’” point of view.

How to Get Started

To embark on a market discovery exercise, set-up a straight-forward interview questionnaire with a maximum of 20 questions. Most questions should be open-ended to get a conversation going and posed toward the buyer, user, potential or non-buyer. All questions should focus on what’s important to them (your questions must have context to be useful later).

Common of questions are:

- How do you define a great day (week) at work?

- What has gone well?

- What are some of the biggest challenges you face with your job?

- If you could address some of these challenges, how would that impact you personally? Your team? Company?

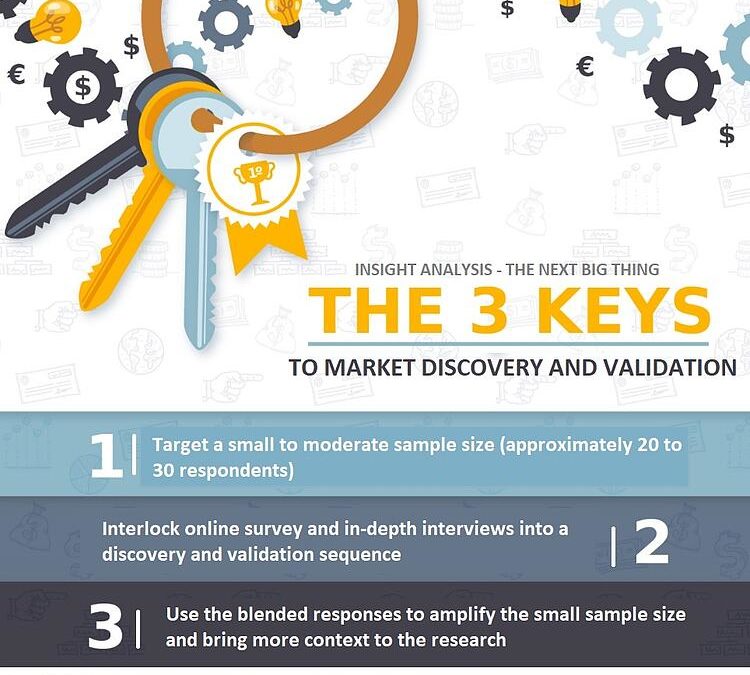

Establish a goal to complete 20 to 30 interviews. When complete, you’ll have a collection of responses that contain a lot of unstructured data.

The logical question is “What can I do with a small sample size of unstructured data? How can I show meaningful analysis? How can I begin to make sense of this effort?”

This next stage is similar to taking shale and producing oil. There is potential for great wealth in the grains of information. Realizing the value of this activity is tied to how well you organize the collection up front and how you extract it. You don’t need to be expert in statistics or market research to provide defensible information backed by good analytics, but preparation and proper tools are key.

Even though you are conducting a series of one-on-one interviews, an online survey tool such as SurveyMonkey or Survey Gizmo is beneficial. Structuring the interview in the tool will standardize the order you ask the questions and the collection of response. The text analysis and filtering tools allow you to manipulate and sort data, and are key to a market discovery exercise.

There are some great examples of how to get meaningful confidence levels from small samples sizes in the usability community that can work for marketing discovery activities. Check out Measuring U, a very useful site on this topic.

Market Discovery Vs. Other Research

Conduct market discovery interviews first and follow-up with an online survey. This enables you to embed what you learned in the first stage and, therefore, improves the quality of the information you collect. That’s not to say we should throw other research methods, like online surveys to the wind. They are critical to the complete discovery and validation process, and are easy and fast and you can reach a bigger audience. Or if you need validation of a known concept or idea, and a high-degree of confidence, market discovery has limited benefits.

Market discovery activities require a less effort and time to set-up compared with more formal research efforts. However, the biggest advantage is the understanding and insight gained regarding customers, potentials and non-buyers. We learn about the world in which they live. We gain empathy for their situations, challenges and opportunities. And it’s then, that we discover an opportunity that will improve our products in the short term and over the long haul.

That’s not to say we should throw other research methods, like online surveys to the wind. They are critical to the complete discovery and validation process, and are easy and fast and you can reach a bigger audience. Or if you need validation of a known concept or idea, and a high-degree of confidence, market discovery has limited benefits.

Conduct market discovery interviews first and follow-up with an online survey. This enables you to embed what you learned in the first stage and, therefore, improves the quality of the information you collect.

When used in the early phases of the product management process, market discovery—like other lean activities—will provide the product team with high value as it helps define “the what” and confirms that it is real.

With this approach, you should be able to share with your stakeholders the best ideas using a combination of qualitative insight with small sample size analytics.

What are your thoughts on market discovery? Do you use this approach with customer? Leave a comment and let us know.